It is true that NPS is a long term investment product, designed to keep Pension in mind after retirement. However, as a product it has evolved in recent times and addressed almost every aspect of our investment, whether it is for retirement, tax saving, short term goals etc.

One of the most sought demand in NPS to make it stand with other financial products was to get same day NAV. So, keeping the pace of time and to make NPS a one stop solution for all our investment needs, the feature of getting same day NAV is made available under NPS.

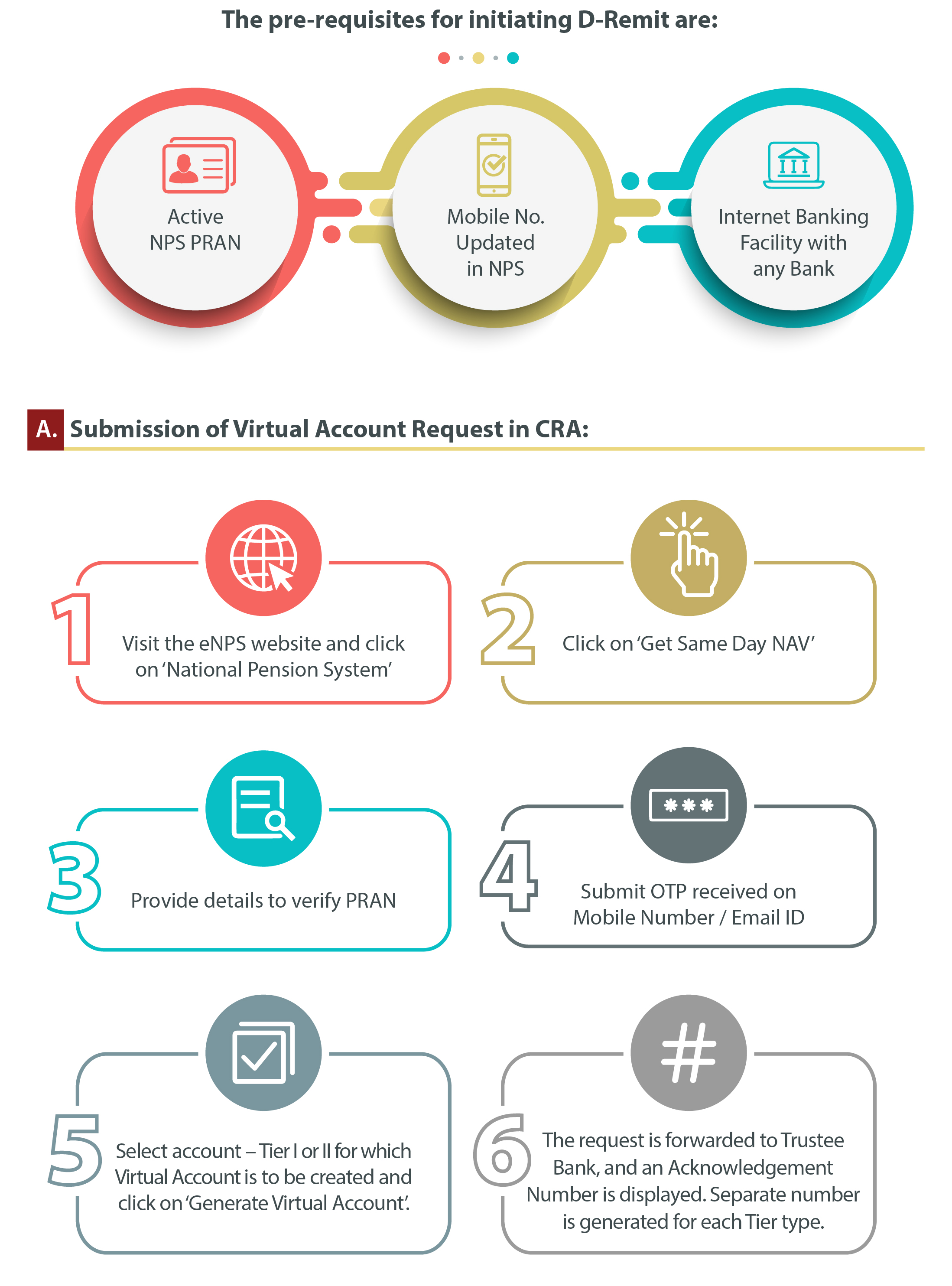

For getting the same day NAV, Direct remittance (D-Remit) is to be carried out to Trustee Bank (currently Axis Bank) instead of going through the intermediary (service provider) account. D-Remit is an electronic system through which money can be directly transferred from your Bank account to the Trustee Bank so that you can get same day NAV for your investment in NPS. It also eases the mode of deposit of voluntary contributions by the Subscribers. A Subscriber only needs to have a Virtual ID (Account) with Trustee Bank to use D-Remit. The Virtual Account with the Trustee Bank can be used only for remitting NPS contributions.

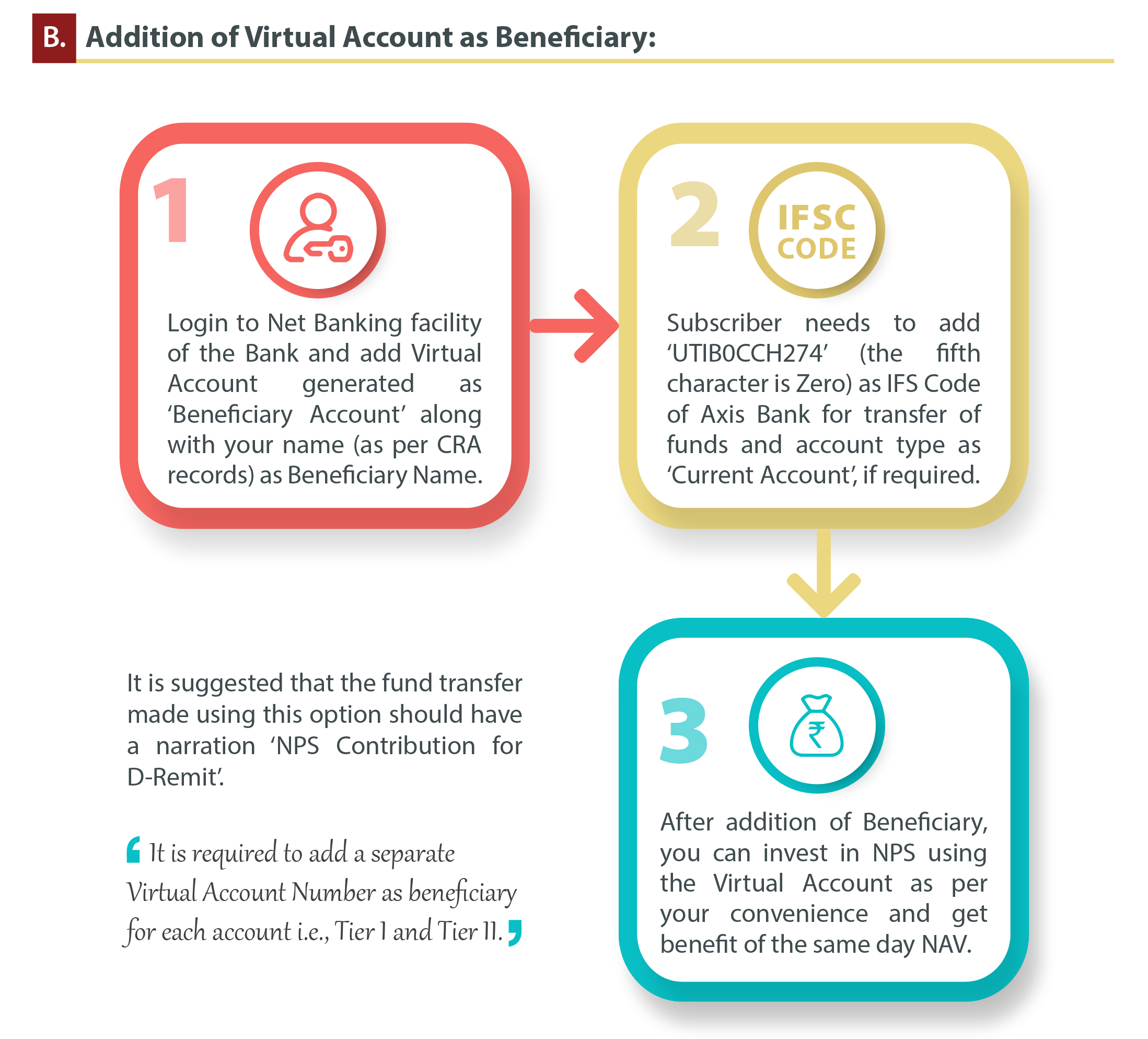

After authorization by Trustee Bank (by next working day), Virtual Account becomes active. A confirmation on activation is sent from the CRA system. In case, you are using D-Remit facility for both the Tiers, two separate Virtual Accounts are created. The sixth digit of your Virtual Account with ‘1’ or ‘2’ is the identifier for Tier I and Tier II accounts respectively. It is required to create separate Virtual Account Number for both the account of NPS i.e. Tier I and Tier II. After creation of Virtual Account, the next step is to add it as Beneficiary:

Please click here to get step by step guide to create virtual ID at eNPS website

Important Points to Note:

- To get same day NAV, the cut-off time for fund receipt is 9.30 AM. In case of receipt of funds after 9:30 AM (or funds received on a non-working day – Saturday, Sunday or a Public Holiday), NAV of the next working day will be applicable. Please note that the cut-off timelines mentioned are subject to regulatory changes.

- Please note that the minimum contribution amount through D-Remit feature is Rs. 500 and above for both the Tiers respectively.

- Please use RTGS/NEFT/IMPS as the mode of remittance for utilising the facility of D-Remit to Trustee Bank.

Once you add the Virtual Account as beneficiary, depending on the features provided by your Bank, Standing Instruction to your NPS account can also be utilized. If you give a Standing Instruction to the bank, from your account, the money will be directly debited and you will get same-day NAV in NPS.

Why should you set a SIP

SIP allows you the convenience of timely and small investments on a regular basis. Just in case you are not convinced, let us take you through some of the benefits of setting up an SIP:

For setting up your SIP, once you generate your Virtual Account, follow the process of adding the Virtual Account as a beneficiary.

Post addition of the Virtual Account as a beneficiary, set a Standing Instruction through the same internet banking login for investing a specified amount on a regular interval to your NPS accounts. Most Banks these days provide this facility.